Caring for your Jewellery while abroad

Heading to the Mediterranean this season? While you soak up the sun, make sure your diamonds are just as radiant when...

Excerpt from the Forbes article

Lightbox, a De Beers-owned company that produces laboratory-grown diamond jewelry, officially opened its $94-million manufacturing facility in Gresham, Ore., Thursday. The 60,000-square-foot building located about 20 miles east of Portland started manufacturing this summer as construction was being completed. It will continue to ramp up production through the rest of the year. Once fully operational, it will produce approximately 200,000 carats of lab-grown diamonds annually, company representatives said. SOURCE: DeMArco A. (2020,Sept, 29) Forbes, De Beers’ Lightbox Opens $94 Million Lab-Grown Diamond Facility, Partners With Blue Nile

In addition to the new building, the company also announced that it has entered into a partnership with online jewelry retailer, Blue Nile, to produce an exclusive fashion jewelry collection with Lightbox lab-grown diamonds. The new jewels launched on the Blue Nile website Thursday, marking the first time in the Seattle-based company’s 21-year history that it will sell lab-grown diamonds.

De Beers will lose roughly US$20 million a year from a factory that costs almost $100 million to build.

Currently, lab-grown diamonds (LGD) or man-made diamonds are being sold at prices related to natural diamonds. The justification for that is wrong because natural diamond prices quadruple for diamonds of twice the carat weight. Man-made diamonds of twice the carat weight cost less than twice as much to manufacture. De Beers is selling all carat weight LGD’s for $800 per carat independent of the size of the diamond.

De Beers wants to establish man-made diamonds for fun and not symbols of lasting love or status. In essence a fun equivalent of a super dooper Cubic Zirconia (CZ).

The factory will manufacture 200,000 carats of diamonds which will sell at US$800 per carat. That is $16 million a year. However, the factory cost $94 million. Engineers I know in India estimate the cost of production as less than $200 per carat. That means De Beers built a factory for $94 million that produces $4 million dollars of diamonds a year. The diamonds need to be polished – that will happen in India at an additional cost. The Forbes article mentions 60 full-time engineers and admin staff, say $6 million dollars of salaries. Clearly, this business will run at a loss.

The economics just do not add up now, but they still have to be cut and polished marketed sorted for quality and sold so at $800 a carat as the retail price. It’s pretty clear that their profitability will be minimal so this factory will run at a loss but what it does establishes a benchmark pricing structure for all other companies that are manufacturing lab-grown or man-made diamonds.

Low-quality diamonds make up about half the value of diamonds from most diamond mines. Man-made diamonds will cannibalise low-quality diamonds.

As LGD production increases they will replace most low quality ‘not quite right’ looking diamonds in shopping mall jewellers around the world. Some mines will close. Diamond prospectors already struggle for funding. Very few or no new mines will be found to replace aging mines like Australia’s Argyle.

The Argyle mine doubled the quantity of the world’s diamonds over its lifetime. But the rough diamonds had very low value, averaging $6 to $10 per carat. Better looking LGD’s will replace very cheap brownish heavily included tiny gems. If Argyle were discovered today no financiers would fund a $2B mine. We would never have had Argyle pink diamonds were it not for the demand for very cheap NQR gems.

By decoupling LGD’s from the mined diamond rarity and lowering the price point, the only surviving diamond mines will be those that produce more high-quality natural diamonds. Guess what De Beers mines specialise in?!

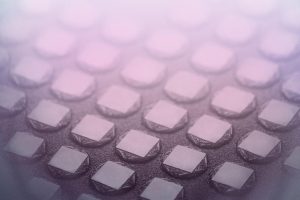

A lab-grown diamond undergoes the cutting and polishing process

Diamonds Seeds

If you would like to read more click here

Heading to the Mediterranean this season? While you soak up the sun, make sure your diamonds are just as radiant when...

When it comes to purchasing an engagement ring, the diamond isn’t the only star of the show. The setting style can...

Investing in gold jewellery is a time-honoured tradition that continues to shine in 2025. Gold has been a reliable...