Caring for your Jewellery while abroad

Heading to the Mediterranean this season? While you soak up the sun, make sure your diamonds are just as radiant when...

The demand from consumers and retailers to know the country of origin began about a decade ago. Back then the technology and ability to store that information and track each rough diamond’s journey through the rough sale, cutting process and sale to a retailer relied on then non-existent software and systems. Gradually these processes are being implemented.

Consider each rough diamond. Most larger stones are sawn and cut into two or up to 20 smaller diamonds. Most diamond cutting manufacturers on-sell some of their rough diamonds. One of our suppliers rarely polishes any diamonds below half a carat. Tiffany’s cutting manufacturer, Laurelton, has annual sales where they sell off rough. While each of those companies knows the origin of all or most of their rough diamonds, most of the smaller companies that buy the goods will not have the sophisticated facilities to handle individual identification.

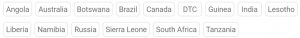

One of our large suppliers identifies the origins of more than 2/3rds of their diamonds. That number is growing as they sell out of older stocks and as more of their rough is tracked through their processes. The numbers I mentioned above are from my actual searches and number crunching. They are growing all the time over the past few years.

Now the savvy readers may have noticed DTC is listed in the countries – that is De Beers rough diamond trading arm. For a while, De Beers was not identifying the country of origin, until my friend Martin Rapaport called them publicly out at a Vegas lecture I attended in 2019. Eventually, all the diamonds that De beers mine in Botswana and Namibia (in partnership with those governments), as well as Canada and South Africa, will all be traceable individually. The De Beers story is controversial. While writing this I had a look at Wikipedia and noticed some misinterpretations of De Beers history and so I made this Wiki edit:

Before the year 2000, for half a century, De Beers tried to force independent producers to join its single-channel rough diamond marketing monopoly. When that did not work, it flooded the market with diamonds similar to those of producers who refused to join in. A point in case where De Beers old market power failed was with Argyle. The Argyle joint venture started in the early 1980s between Ashton Mining, who discovered the mine and Rio Tinto, who funded and operated Argyle for a 60% share of the business. When they began selling diamonds they sold almost all through the De Beers channel. However, over time Argyle began to market more of their goods and established client bases directly with several Indian manufacturers polishing companies.

In 1996 Argyle refused to sign up and marketed 100% of the mine run. De Beers threatened to, and then actually dumped as much of the lower quality small brownish diamonds that Argyle supplied De Beers with on the market as punishment. This was not such a big issue for Rio – one of the two largest mining companies in the world, and a rather silly bluff by De Beers.

At about the same time, George Soros caused a currency crisis in South East Asia which resulted in a lot of ‘Asian’ diamonds being sold to raise cash. Asian diamonds are predominantly fungible diamonds – top colour and clarity that can be sold quickly based on a GIA grading report, with no need to scrutinize the diamond itself. This caused the often misunderstood ‘stockpiling’ with De Beers holding ‘Asian’ goods back from the market.

They waited a few years to begin selling that inventory. However, that meant their asset value rose as the safes filled. That caused De Beers to became a takeover target on the stock market, and in a defensive move, they privatized the then public company in 2001. Anglo American, the Oppenheimer family, Botswana and Namibian governments all kicked in and bought out the institutional and private investors. Part of that deal led to the transfer of De Beers operations to Botswana from where they continue to operate their HQ today.

Today Alrosa, the Russian diamond marketing company, and De Beers each mine about a third each of the worlds rough diamonds, with a dozen or so smaller companies making up around 20% of production with about 10% coming from artisanal alluvial or river panning miners – mainly in Africa and Brazil.

Heading to the Mediterranean this season? While you soak up the sun, make sure your diamonds are just as radiant when...

When it comes to purchasing an engagement ring, the diamond isn’t the only star of the show. The setting style can...

Investing in gold jewellery is a time-honoured tradition that continues to shine in 2025. Gold has been a reliable...